Cloudy Outlook for Growth in Emerging Europe and Central Asia

“The Emerging Europe and Central Asia region is facing some daunting challenges amid a cloudy outlook for growth,” said Laura Tuck, Vice-President for the World Bank’s Emerging Europe and Central Asia region. “The tensions in Ukraine have clearly had an impact on the country’s growth and have disrupted economic activity. But many of the structural problems that confront countries in the region existed before the crisis and still need to be urgently addressed.”

Added Tuck, “While we monitor the impact of the Ukraine crisis on the region, it is important not to lose sight of these longer-term issues that countries need to tackle to boost growth and create badly needed jobs. In many countries of Central and Eastern Europe, the challenge is to finally put the economic crisis behind – to kickstart the financial sector and improve the business climate. In the Balkans, deepening institutional reforms and improving governance are crucial. In Russia and many neighboring countries, key are reforms to enhance competitiveness and create sources of growth beyond oil and gas.”

Signs of recovery

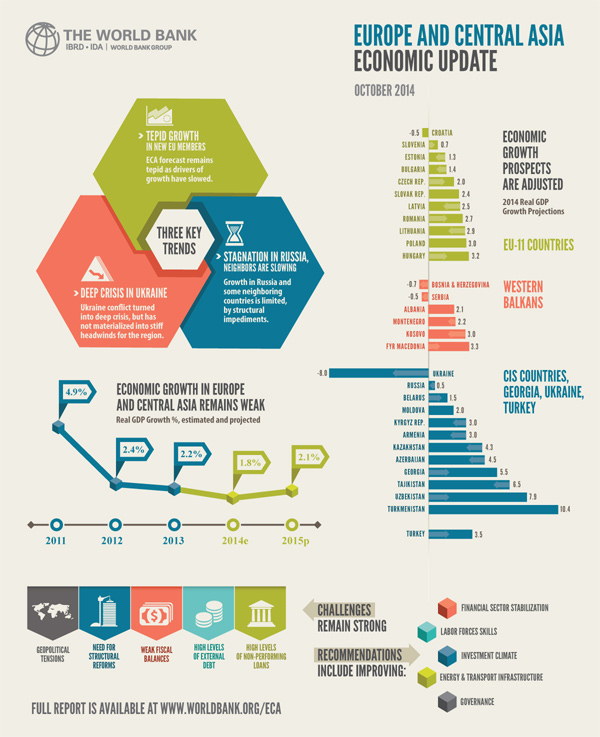

Some signs of hope show through in the region. Central and East European (CEE) countries are expected to see growth accelerate to 2.5 percent in 2014 and to 2.8 percent in 2015 – a significant improvement from the previous two years when growth was very modest (0.8 percent in 2012 and 1.3 percent in 2013). But recovery in the new EU member states remains mixed and growth in Western Europe is disappointing.

Unemployment rates in several countries have peaked and are now showing signs of improvement. While they remain above 10 percent in several CEE countries, they are declining the most in countries such as Estonia, Latvia, and Lithuania, where structural reforms and prudent policies were implemented swiftly. Given past trends, these positive developments are expected to be reflected in higher income growth for the bottom 40 percent of the population.

In the Western Balkans, economic growth is expected to drop from 2.4 percent in 2013 to only 0.6 percent in 2014, due to its debt overhang that is reducing financing for business and lack of reform momentum, and then recover modestly to a projected 1.9 percent in 2015.

Ukraine crisis

Meanwhile, in Ukraine, geo-political tensions have developed into a deep crisis for the country. Recent trends point to a sharper decline in Ukraine’s real GDP in 2014 and continued retrenchment in 2015 compared to earlier projections. Ukraine’s GDP is expected to contract 8 percent in 2014 and 1 percent in 2015.

The conflict in the east has disrupted economic activity, made collection of taxes difficult, adversely affected exports, and hurt investor confidence. Meanwhile, weak revenue performance, rising spending pressures, and a growing Naftogaz deficit make fiscal adjustment more challenging. The current account deficit has adjusted because of the sharp depreciation, but balance of payments pressures remain high due to large external debt refinancing needs, low FDI, and limited access to external financing. A prolonged confrontation in the east, constrained credit supply due to risks in the banking sector, constrained domestic consumption, and investment demand all pose risks and affect prospects for recovery.

Russian stagnation

In Russia, the World Bank warned earlier this year of an unfinished transition, including ongoing problems in the business environment and heavy reliance on oil revenues. Currently, the Russian economy is slowing as its past growth drivers have weakened. GDP growth in Russia was just 0.8 percent in the first half of 2014, compared to 0.9 percent in the first half of 2013.

Economic activity was already hamstrung in 2013 by lingering structural problems and a wait-and-see attitude on the part of both businesses and consumers. An additional negative impact on the economy – besides slow structural reforms – came from increased geopolitical tensions and an uncertain policy environment. It is policy uncertainty about the economic course the country will take that is casting the longest shadow on Russia’s medium-term prospects. There is a greater need for reforms to enhance the business climate to build avenues for growth and less reliance on the energy sector.

The Commonwealth of Independent States (CIS) economies have faced headwinds due to the crisis in Ukraine and ongoing stagnation in Russia, however broad spill-overs to other countries have been limited so far. Immense reliance of the CIS economies on energy exports persists, and progress on structural reforms has slowed. Growth for these countries is expected to be a meager 1 percent in 2014 and to rise only slightly to 1.3 percent in 2015.

In Turkey, growth has also slowed from over 4 percent in 2013, but is projected to stabilize at about 3.5 percent in 2014 and 2015.

Going forward

“The forecast for the Emerging Europe and Central Asia region remains tepid because of deferred structural reforms, as well as ongoing weak growth in Western Europe and stagnation in Russia,” noted Hans Timmer, Chief Economist in the World Bank’s Emerging Europe and Central Asia region. “Economic growth in the region remains lower than in most other regions of the world. Going forward, the emphasis should be on improving governance and the investment climate, strengthening competitiveness, ensuring the stability of the financial sector, and maintaining a sound macroeconomic framework.”

“To be sustainable in the longer term, economic growth and shared prosperity need to be fiscally affordable, environmentally responsible, and conducive to social inclusion,” said Timmer.

The World Bank, working jointly with other World Bank Group institutions, is helping its client countries in Emerging Europe and Central Asia address these and other challenges to reduce poverty and boost shared prosperity through policy dialogue, analytical work, project funding, and reimbursable advisory services.